Hester Peirce, a commissioner at the United States Securities and Exchange Commission (SEC), has openly criticized a longstanding SEC policy that restricts defendants from publicly disputing the agency’s allegations after reaching a settlement. Known as the “gag rule,” this policy, established in 1972, effectively silences defendants from denying the SEC’s claims or suggesting that the complaints lack a factual basis. Peirce argues that this rule not only undermines the integrity of regulatory practices but also poses significant concerns regarding the First Amendment rights of free speech.

The Controversy Surrounding the SEC’s Gag Rule

The gag rule in question mandates that defendants in SEC enforcement actions refrain from making any public statements that deny, directly or indirectly, the allegations made by the commission in the complaint. This condition is a standard, non-negotiable part of settlements with the SEC, which Peirce believes casts a shadow over the commission’s transparency and accountability. According to Peirce, this policy not only inhibits defendants from expressing their viewpoints but also effectively insulates the SEC’s allegations from public scrutiny and debate.

Peirce’s critique extends to the vagueness of the rule, which, in her view, leaves defendants uncertain about the extent of the restrictions placed upon them. Furthermore, the requirement that defendants must not “permit” any third-party denials of the SEC’s allegations raises additional concerns about the practical enforceability of the rule and its implications for the defendants’ control over independent third-party expressions.

The Impact on Regulatory Integrity and Free Speech

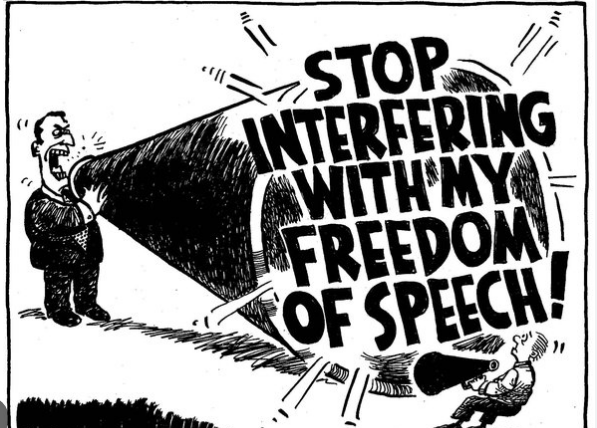

The fundamental issue at the heart of Peirce’s critique is the balance between regulatory enforcement and the preservation of constitutional rights. By preventing defendants from voicing their disagreements with the SEC’s claims post-settlement, the gag rule potentially stifles open dialogue and critique that are essential for the integrity of regulatory processes. This policy may create an environment where regulatory actions go unchallenged, reducing the opportunity for public discourse and reflection on the SEC’s practices and decisions.

Moreover, the implications for free speech are profound. The First Amendment protects the right to free expression, including the right to criticize governmental actions and policies. The SEC’s gag rule, by curtailing this fundamental right, may set a concerning precedent for the extent to which regulatory bodies can control the narrative surrounding their enforcement actions.

The Broader Context of SEC Enforcement Actions

Peirce’s criticism comes at a time when the SEC’s enforcement actions, particularly those related to cryptocurrency, have reached a decade-high. With a significant increase in actions against crypto firms and substantial penalties collected from settlements, the relevance and impact of the gag rule are more pronounced. The policy’s implications extend beyond individual defendants, affecting the broader financial and technological sectors regulated by the SEC.

The comparison with other federal agencies, such as the Federal Trade Commission, which allow settling defendants to deny allegations, highlights the uniqueness and potential overreach of the SEC’s policy. This discrepancy raises questions about the necessity and fairness of the SEC’s approach, especially considering the enormous financial and legal burdens that SEC investigations impose on defendants, pushing many towards settlement as the most viable option.

Moving Forward: The Need for Policy Reevaluation

Peirce’s call for a reevaluation of the SEC’s gag rule reflects a broader debate on the balance between regulatory authority and individual rights. As the financial landscape continues to evolve, with new challenges emerging from the rise of digital assets and cryptocurrencies, the need for transparent, accountable, and fair regulatory practices becomes increasingly important.

Read More:

- Prosecution depicts gruesome murder of Florida commissioner in court

- Florida therapist charged with murder after body found in trunk

- U.S. Supreme Court Declines Epic Games’ Antitrust Challenge Against Apple’s App Store Policies

Reconsidering the gag rule could represent a significant step towards enhancing the regulatory integrity of the SEC, ensuring that its enforcement actions are subject to public scrutiny and debate. Such a move would not only align the commission’s policies with fundamental democratic principles but also foster a more open, constructive dialogue between regulators, defendants, and the public they serve.